In the complex world of international trade, the HS code is an essential universal language. This standardized numbering system allows goods to be classified globally, ensuring correct tariff application and smooth customs flow. Discover its importance!

HS Code in Logistics: Definition and Uses

HS Code is the abbreviated form of the harmonized coding and description system for goods, present in more than 200 countries. It is a list of numbers used in customs for the following purposes:

- Classify products: Determine the category to which a product belongs for customs purposes.

- Apply tariffs: Define the taxes and duties that must be paid for the import or export of a product.

- Control trade: Help customs authorities monitor the flow of goods and apply restrictions or prohibitions.

- Collect statistics: Allows the generation of data on international trade of different products.

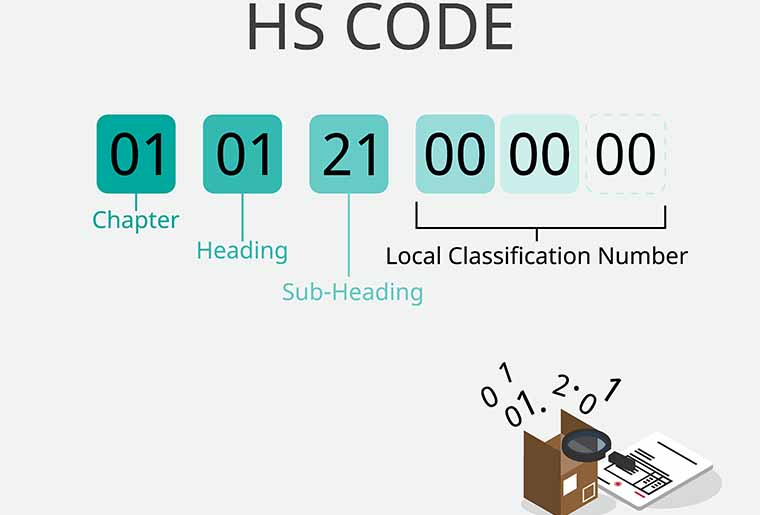

HS codes consist of at least six digits:

- The first two digits indicate the chapter or general category of the product.

- The next two digits indicate the heading, further detailing the product within the chapter.

- And the last two digits indicate the subtitle, providing greater specificity.

Some countries add more digits to classify products in greater detail. If the goods do not include the harmonized code, the recipient risks paying the wrong duty and may cause unnecessary delays.

In short, HS codes are an essential tool in international logistics for the classification, regulation, and control of trade in goods.

When is it essential to have a correct HS code?

Providing the correct HS code is critical when the products being transported are manufactured outside of Europe and the United Kingdom. With these types of orders, completing import and export procedures is mandatory. The HS code ensures the accurate classification of the parts, facilitating customs clearance and timely delivery to their destination without delays.

Why is it necessary to use HS codes correctly?

Remember! Using HS codes correctly is crucial for several reasons:

1. To pay the correct customs duty: Trade unions have established a preferential agreement among themselves. This means that there is a discount on tariffs for certain items. Without the correct HS code, you could pay more than necessary. If you pay less than you should, you risk a fine or suspension. Make sure you use the correct code to pay the correct amount.

2. To avoid the risk of delay: With an incorrect code, customs authorities cannot identify your shipments. While they determine what goods you are sending, your shipment waits in customs. To avoid these types of delays, use the correct codes.

3. To avoid fines or destruction of goods: Authorities use HS classification to identify prohibited goods. Some countries restrict the import of certain products. In most cases, you need a specific permit. Without it, you could face fines and the destruction of your shipment.

4. To increase customer satisfaction: On-time deliveries without unforeseen delays can improve customer satisfaction and increase the potential for more business.

How to obtain the HS code?

The World Customs Organization (WCO) is responsible for developing and updating the Harmonized System and has a tool that can be used to obtain the code: https://www.wcotradetools.org/en/harmonized-system. Additionally, the HS code can be obtained from the website of the government of the country of origin. Another way is to use an online harmonized code search engine, simply describing the product to obtain the code. For example, if the merchandise contains women’s short-sleeved T-shirts made of 100% cotton, the HS code would be:

- Category: Textiles and Articles (62)

- Subcategory: T-shirts and other vests (11)

- Material: Cotton (42)

- The merchandise’s HS code: 621142

This number allows customs authorities around the world to identify the contents of the shipment.

HS Code and HTS Code. Is There a Difference?

Yes, there is. Although HS codes and HTS codes serve similar purposes, they are used by different countries and customs territories.

The Harmonized Tariff System (HTS) is specific to the United States and is based on the HS nomenclature. An HTS code has 10 digits, four more than an HS code. Additional digits follow the first six. The first two additional digits represent the tariff rate, and the last two are used for trade data. These final digits do not actually classify the product and are usually listed as ’00’, as they are not always necessary.

At this point, you’ll be interested to know that HTS codes are only for imports into the United States. For exports, Schedule B numbers are used.

Tips for using HS codes correctly in shipments.

Always check if the codes are up to date. Regularly monitor updates to codes, tariffs, and trade regulations.

Keep in mind that some countries have their own set of codes. We already mentioned the US HTS codes, but China also has its own codes.

Although the classification is global, some countries have a different classification for certain items. For example, Switzerland (Tares: Tarif suchen).

Consult with your expert or customs broker. Most customs authorities are also willing to share their expertise.

As we have seen, the correct application of the HS code goes beyond a formality; it is critical to the success of your international logistics operations. An incorrect code can result in delays, unexpected fines, or even the destruction of goods, directly affecting your profitability and customer satisfaction. At Partida Logistics, we are specialists in customs management and fully understand the complexities of the Harmonized System and its specificities in each country. Our expert team guarantees an accurate classification of your products, ensuring regulatory compliance, the correct application of tariffs, and a smooth, seamless customs clearance. Trust us to optimize your shipments and eliminate any risk resulting from incorrect classification.